Solar Panel and Insurance: What You Need to Know

Understanding Homeowners Insurance and Solar Panels Key Considerations

So, you're thinking about going solar? Awesome! You're joining a growing movement of folks who are saving money and helping the planet. But before you slap those shiny new panels on your roof, let's talk insurance. It's not the most exciting topic, but it's super important to make sure you're covered in case something goes wrong. Think of it as getting a safety net for your investment.

Your standard homeowners insurance policy might cover your solar panels, but don't assume anything! You need to check the fine print. Most policies cover damage from things like fire, wind, hail, and vandalism. The big question is whether they treat solar panels as part of the "dwelling" (your house) or as "personal property." If they're considered part of the dwelling, they're usually covered. If they're personal property, coverage might be limited. And this is all before diving into the specifics of your location, because insurance regulations can vary wildly. For example, Florida is going to have different concerns than Colorado.

Call your insurance company and ask them directly, "How does my policy cover solar panels?" Get it in writing! Don't just take their word for it over the phone. Ask for a written endorsement or clarification of your policy. This will save you a huge headache down the road.

Factors Affecting Solar Panel Insurance Costs Impact on Premiums

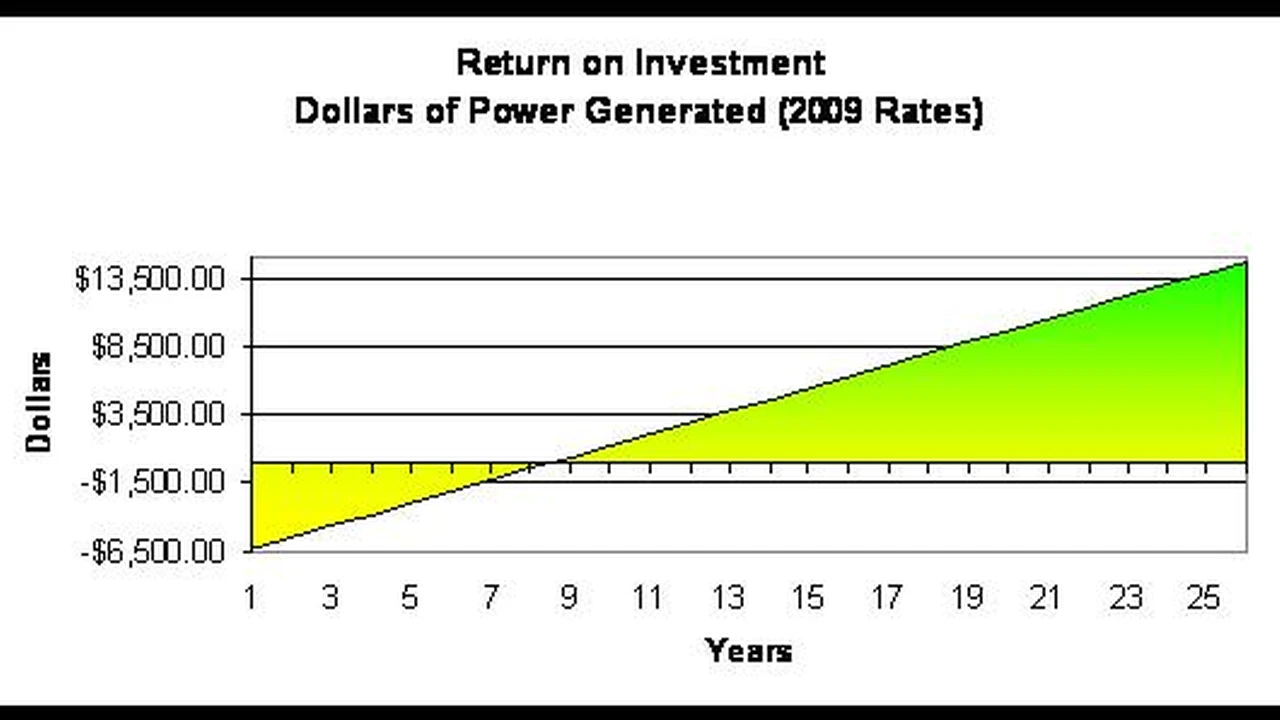

Alright, let's talk dollars and cents. Adding solar panels can definitely affect your homeowners insurance premiums. Why? Because you're increasing the value of your home. Think of it like adding a fancy new kitchen – the more valuable your house, the more it costs to insure. It's just simple economics, really.

Several factors influence how much your premiums might increase:

* The cost of the solar panel system: A more expensive system will generally lead to a higher premium. Insurance companies base their rates on the replacement cost. * Your location: Areas prone to severe weather (hurricanes, hailstorms, etc.) will have higher premiums. Insurance companies see you as more likely to file a claim. * Your insurance company: Different companies have different underwriting guidelines. Some are more solar-friendly than others. Shop around! * Your deductible: A higher deductible (the amount you pay out-of-pocket before insurance kicks in) will usually result in a lower premium, and vice versa. * The type of solar panels: Premium or less expensive panels can also affect your insurance costs.Don't be afraid to negotiate with your insurance company. Explain the benefits of solar (e.g., increased home value, reduced energy costs). See if they offer any discounts for energy-efficient homes. Every little bit helps!

Specific Insurance Coverage for Solar Panel Damage Common Claims

What kind of problems are we talking about here? Well, the most common claims related to solar panels involve:

* Weather Damage: Hail, wind, and lightning are the biggest culprits. Hail can crack the panels, wind can rip them off the roof, and lightning... well, lightning is just bad news for everything. * Theft and Vandalism: Sadly, solar panels can be targets for thieves, especially in areas with high electricity costs. Vandalism is also a possibility. * Fire: While rare, electrical malfunctions can cause fires. Proper installation and maintenance are crucial to prevent this. * Animal Damage: Believe it or not, squirrels and birds can wreak havoc on your solar panels by chewing on wires or nesting underneath them. * Snow and Ice Damage: The weight of heavy snow or ice accumulation can damage your panels or mounting structure.Your insurance policy should cover the cost to repair or replace your solar panels if they're damaged by a covered peril (like the ones listed above). Make sure you understand your policy's deductible and coverage limits. For example, if your deductible is $1,000 and the repair costs are $1,500, you'll pay $1,000, and the insurance company will cover the remaining $500.

Keep detailed records of your solar panel system, including the purchase date, installation date, cost, and warranty information. Take photos of the panels before and after installation. This documentation will be invaluable if you ever need to file a claim.

Solar Panel System Warranties and Insurance Overlap Understanding the Differences

Here's where things can get a little confusing. Your solar panels will likely come with a warranty from the manufacturer and/or the installer. These warranties typically cover defects in materials and workmanship. However, they usually don't cover damage from external factors like weather or vandalism. That's where your homeowners insurance comes in.

Think of it this way: the warranty covers problems that are the manufacturer's or installer's fault, while insurance covers problems that are nobody's fault (or someone else's fault, like a vandal).

Read your warranty carefully to understand what's covered and for how long. Some warranties are for 25 years or more, while others are shorter. Also, be aware that some warranties may be voided if you don't follow the manufacturer's recommendations for maintenance and care.

If you have a problem with your solar panels, the first step is to determine whether it's covered by the warranty or by your insurance policy. Contact the manufacturer or installer if you suspect a defect in materials or workmanship. Contact your insurance company if the damage was caused by an external factor.

Tips for Choosing the Right Insurance Policy for Solar Panels Protecting Your Investment

Okay, so how do you make sure you're getting the right insurance coverage for your solar panels?

* Shop around: Get quotes from multiple insurance companies. Don't just go with the first one you find. * Compare coverage: Pay attention to the details. What perils are covered? What are the coverage limits? What's the deductible? * Ask questions: Don't be afraid to ask the insurance agent to explain anything you don't understand. * Read the fine print: Before you sign on the dotted line, make sure you read the entire policy carefully. * Consider a rider: If your standard homeowners insurance policy doesn't provide adequate coverage for your solar panels, you may want to consider adding a rider (an endorsement that adds extra coverage).It's also a good idea to review your insurance policy annually to make sure it still meets your needs. As your solar panel system ages, its value may decrease, and you may be able to reduce your coverage limits accordingly.

Solar Panel Insurance Claims Process Steps to Take After Damage

So, disaster strikes! Your solar panels are damaged. What do you do?

1. Document the damage: Take photos and videos of the damage. This will be helpful when you file your claim. 2. Contact your insurance company: Report the damage as soon as possible. The sooner you file a claim, the better. 3. Protect the property: If possible, take steps to prevent further damage. For example, if a panel is cracked, cover it with a tarp to prevent water from getting in. 4. Get estimates: Obtain estimates from qualified solar panel repair companies. Your insurance company may require you to get multiple estimates. 5. Cooperate with the insurance adjuster: The insurance company will send an adjuster to inspect the damage. Be prepared to answer their questions and provide them with any documentation they need. 6. Review the settlement offer: Once the insurance company has assessed the damage, they will make you a settlement offer. Review the offer carefully to make sure it covers the cost of repairs or replacement. 7. Negotiate if necessary: If you're not happy with the settlement offer, you can negotiate with the insurance company. Be prepared to provide evidence to support your claim. 8. Get the repairs done: Once you've reached an agreement with the insurance company, you can hire a contractor to repair or replace your solar panels.Keep all records related to the claim, including photos, estimates, and correspondence with the insurance company.

Beyond Homeowners Insurance Additional Solar Panel Coverage Options

While homeowners insurance is the primary way to protect your solar panels, there are other options to consider:

* Equipment Breakdown Coverage: This coverage, which is often added as an endorsement to your homeowners insurance policy, covers damage to your solar panels caused by mechanical or electrical breakdown. This can be helpful if a component fails due to a manufacturing defect or wear and tear. * Business Insurance: If you're running a business from your home and using solar panels to power it, you may need a business insurance policy to cover them adequately. * Solar Panel-Specific Insurance: Some insurance companies offer policies specifically designed for solar panels. These policies may provide more comprehensive coverage than standard homeowners insurance.Talk to your insurance agent to determine which options are best for your situation.

Specific Solar Panel Products and Their Insurance Implications

Let's look at a few specific solar panel products and how they might affect your insurance needs. Keep in mind that these are just examples, and you should always consult with your insurance company for specific advice.

* SunPower Maxeon Panels: These are high-efficiency panels known for their durability and long lifespan. Because they're more expensive than some other panels, insuring them will likely result in a higher premium. However, their durability might reduce the risk of damage from hail or wind, which could offset the cost somewhat. * Use Case: Ideal for homeowners who want maximum energy production from a limited roof space. * Comparison: More expensive upfront than standard panels but offer higher efficiency and a longer lifespan. * Price: Typically around $3.00 - $4.00 per watt installed. * LG NeON 2 Panels: Another high-performance option, LG NeON 2 panels are known for their aesthetic appeal and strong warranty. Similar to SunPower, their higher cost will likely translate to higher insurance premiums. * Use Case: Suitable for homeowners who prioritize aesthetics and performance. * Comparison: Similar performance to SunPower but may have a slightly different appearance. * Price: Typically around $2.80 - $3.80 per watt installed. * REC Group Alpha Series Panels: These panels offer a good balance of performance and affordability. They're a popular choice for homeowners looking for a reliable system without breaking the bank. Because they're less expensive than SunPower or LG panels, insuring them may result in a lower premium. * Use Case: A good all-around choice for homeowners who want a balance of performance and affordability. * Comparison: Good performance at a more competitive price point. * Price: Typically around $2.50 - $3.50 per watt installed. * Canadian Solar HiKu Panels: A more budget-friendly option, Canadian Solar HiKu panels are a good choice for homeowners who are looking to save money on their solar installation. Insuring these panels may result in the lowest premium of the options listed here. * Use Case: Ideal for homeowners on a tight budget. * Comparison: More affordable than premium panels but may have slightly lower efficiency and a shorter lifespan. * Price: Typically around $2.00 - $3.00 per watt installed.When choosing solar panels, consider not only their performance and cost but also their insurability. Talk to your insurance company about the specific panels you're considering to get an accurate estimate of your insurance costs.

Off-Grid Solar Panel Insurance Considerations Unique Challenges

If you're living off-grid and relying solely on solar power, your insurance needs may be different. Because you're not connected to the grid, a power outage could have more serious consequences. You may want to consider:

* Backup Power: Having a backup generator or battery system can provide power during extended periods of cloudy weather or equipment failure. Make sure your insurance policy covers these backup systems as well. * Liability Coverage: If someone is injured on your property due to your off-grid solar system, you could be held liable. Make sure your insurance policy provides adequate liability coverage. * Remote Location Coverage: If you live in a remote area, it may take longer for emergency services to reach you. Consider adding coverage that will help you pay for temporary housing or other expenses if you have to evacuate your home due to a power outage or other emergency.Off-grid solar systems present unique challenges, so it's important to work with an insurance agent who understands these challenges and can help you choose the right coverage.

The Future of Solar Panel Insurance Emerging Trends

The solar industry is constantly evolving, and so is the insurance industry. Here are a few emerging trends to watch:

* More Solar-Specific Policies: As solar becomes more mainstream, we're likely to see more insurance companies offering policies specifically designed for solar panels. These policies may offer more comprehensive coverage and more competitive rates. * Smart Home Integration: Some insurance companies are offering discounts to homeowners who install smart home devices, such as smart thermostats and water leak detectors. Integrating your solar panel system with a smart home system could potentially lead to lower insurance premiums. * Drone Inspections: Insurance companies are increasingly using drones to inspect solar panels for damage. This can make the claims process faster and more efficient. * AI-Powered Risk Assessment: Insurance companies are using artificial intelligence to assess the risk of insuring solar panels. This can help them to identify potential problems and offer more tailored coverage.Stay informed about these trends so you can make the best decisions about your solar panel insurance.

Maintaining Your Solar Panels to Minimize Insurance Claims Proactive Measures

The best way to avoid insurance claims is to take good care of your solar panels. Here are a few tips:

* Regular Cleaning: Dirt, dust, and debris can reduce the efficiency of your solar panels. Clean them regularly with a soft brush and water. * Professional Inspections: Have your solar panels inspected by a qualified technician every few years. They can identify potential problems before they become major issues. * Tree Trimming: Trim any trees that are shading your solar panels. Shading can significantly reduce their energy production. * Monitor Performance: Keep an eye on your solar panel system's performance. If you notice a sudden drop in energy production, it could be a sign of a problem. * Secure Mounting: Ensure your solar panels are securely mounted to your roof. This will help prevent them from being damaged by wind or storms. * Snow Removal: If you live in an area with heavy snowfall, remove snow from your solar panels to prevent damage from the weight of the snow.By taking these proactive measures, you can minimize the risk of damage to your solar panels and reduce the likelihood of having to file an insurance claim.

Solar Panel Insurance and Resale Value Impact on Home Sales

Having solar panels can increase the resale value of your home. However, potential buyers may be concerned about the cost of insuring the panels. Be prepared to provide them with information about your insurance policy and the cost of insuring the panels. Highlight the long-term savings on electricity bills, which will easily offset insurance costs.

Also, make sure that the solar panel system is properly maintained and in good working order. A well-maintained system will be more attractive to buyers and may increase the value of your home even further.

Consider offering a home warranty that covers the solar panel system. This can give buyers peace of mind and make your home more attractive to potential buyers.

DIY Solar Panel Insurance Considerations Before You Install

Thinking of installing your own solar panels? While it can save you money upfront, it can complicate insurance. Many insurance companies are hesitant to cover DIY installations due to concerns about safety and code compliance. You MUST ensure your DIY installation meets all local building codes and is inspected by a qualified electrician. Document everything with photos and permits. This documentation is your best bet for getting insurance coverage.

Be upfront with your insurance company about the DIY installation. They may require a professional inspection before they'll provide coverage. If you can't get coverage, it might be worth reconsidering a professional installation. The peace of mind and insurance coverage may be worth the extra cost.

Community Solar and Insurance How it Differs

Community solar is a different beast. You're not owning the panels directly, but subscribing to a portion of a larger solar farm. In most cases, the insurance for the solar farm is handled by the company that owns and operates it. You typically don't need to worry about insuring the panels themselves. However, you should still review your homeowners insurance to ensure you have adequate liability coverage in case of any issues related to your subscription (e.g., if someone is injured while visiting the solar farm). Check the fine print of your community solar agreement to understand who is responsible for insurance and liability.

Tax Credits and Insurance Implications Navigating the Savings

Taking advantage of solar tax credits? Great! But how does that impact insurance? Well, the tax credit reduces the overall cost of your solar panel system, but it doesn't directly affect your insurance premiums. Your insurance premiums are based on the *replacement cost* of the panels, not the price you actually paid after the tax credit. So, while the tax credit saves you money upfront, it won't lower your insurance costs. Think of the tax credit as a bonus that makes solar even more affordable!

Solar Panel Cleaning Services and Insurance Coverage

Regular cleaning is crucial for optimal solar panel performance. If you hire a professional cleaning service, make sure they are insured. This protects you in case they damage your panels during the cleaning process. Ask for proof of insurance before hiring a cleaning service. A reputable company will be happy to provide it. Document the cleaning process with before-and-after photos for your records.

Solar Panel Removal and Reinstallation Insurance Scenarios

Sometimes, you might need to remove and reinstall your solar panels (e.g., for roof repairs). Make sure your insurance policy covers this scenario. Some policies may cover the cost of removal and reinstallation if it's necessary due to a covered peril (like a storm). Get this in writing from your insurance company before you start any removal work. Also, ensure that the company you hire to remove and reinstall the panels is insured. This protects you in case they damage the panels or your roof during the process.

Solar Panel Leasing and Insurance Responsibility

Leasing solar panels complicates insurance. The leasing company typically owns the panels and is responsible for insuring them. However, you should still review your homeowners insurance to ensure you have adequate liability coverage in case of any issues related to the leased panels. Read your solar panel lease agreement carefully to understand who is responsible for insurance and maintenance. Don't assume anything! Get clarification from the leasing company and your insurance company.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)