Solar Panel and Tax Credits: Claiming Your Incentives

So, you're thinking about going solar? Awesome! You're joining a growing movement of people who are not only helping the planet but also saving money on their electricity bills. But let's be honest, the upfront cost of solar panels can be a little intimidating. That's where tax credits and incentives come in! Think of them as a little pat on the back from Uncle Sam (or your state government) for making a smart, green choice.

Understanding Federal Solar Tax Credits for 2023 and Beyond

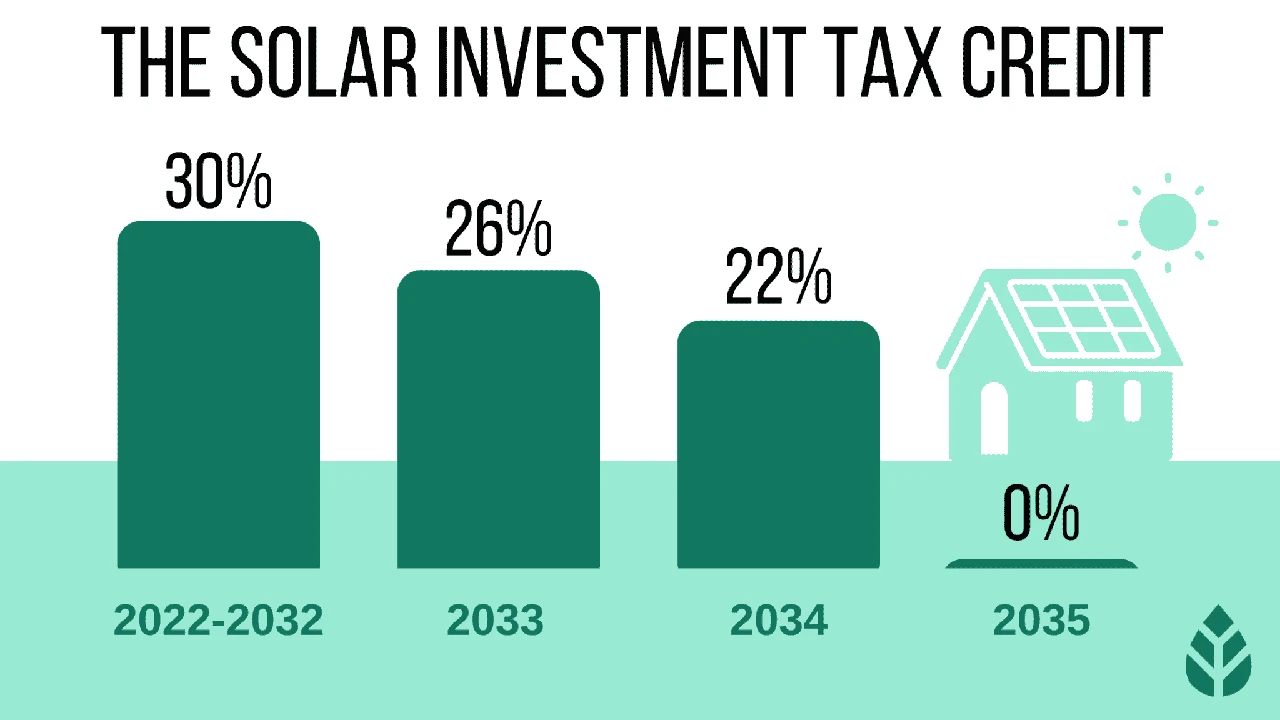

The big kahuna of solar incentives is the Federal Solar Tax Credit, also known as the Investment Tax Credit (ITC). For 2023 and beyond, it's set at a generous 30% of the cost of your solar panel system. That's right, 30%! This includes not just the panels themselves, but also installation costs, wiring, inverters, and even solar batteries. So, if your solar system costs $20,000, you could potentially get a $6,000 tax credit. Pretty sweet, huh?

Here's the catch (there's always a catch, right?): It's a *credit*, not a refund. This means it reduces the amount of taxes you owe. If you don't owe that much in taxes, you won't get the full amount back as a refund. However, the unused portion of the credit can be carried forward to future tax years. So, you'll eventually be able to claim the full amount.

Who's eligible for the Federal Solar Tax Credit? Basically, anyone who owns a solar panel system that's located at their primary or secondary residence in the United States. It also applies to systems installed on commercial properties.

Navigating State and Local Solar Incentives and Rebates

While the Federal Solar Tax Credit is a big deal, don't forget about state and local incentives! These can vary widely depending on where you live, so it's worth doing some research. Some states offer additional tax credits, while others offer rebates or grants. Rebates are particularly awesome because they're often a direct cash payment, rather than a reduction in your taxes.

How to find state and local incentives: A great place to start is the DSIRE (Database of State Incentives for Renewables & Efficiency) website. It's a comprehensive database that lists all the solar incentives available in each state. You can also check with your local utility company, as they often offer rebates or incentives as well. Don't be afraid to Google "[Your State] Solar Incentives" – you might be surprised at what you find!

Solar Renewable Energy Certificates (SRECs) Explained

Okay, this one's a little more complicated, but it can be another source of income from your solar panels. SRECs are essentially credits that represent the environmental benefits of solar energy. For every megawatt-hour (MWh) of electricity your solar panels generate, you earn one SREC. You can then sell these SRECs to utility companies, who need them to meet their renewable energy obligations.

How SRECs work: The value of an SREC varies depending on the state and the demand for renewable energy. In some states, SRECs can be worth hundreds of dollars, while in others they're worth much less. You'll typically need to register your solar system with a tracking system to be able to generate and sell SRECs. There are also companies that specialize in helping homeowners sell their SRECs.

Step-by-Step Guide Claiming Your Solar Incentives on Your Tax Return

Alright, let's get down to the nitty-gritty of claiming your solar incentives. For the Federal Solar Tax Credit, you'll need to fill out IRS Form 5695, Residential Energy Credits. This form is pretty straightforward, but you'll need to know the total cost of your solar system, including installation. You'll also need to keep good records of all your expenses in case the IRS asks for documentation.

Tips for filing Form 5695:

- Make sure you have your installer's invoice handy.

- Double-check all your calculations.

- If you're unsure about anything, consult with a tax professional.

For state and local incentives, the process will vary depending on the specific program. Some may require you to apply before you install your solar panels, while others may allow you to apply after the fact. Be sure to read the instructions carefully and follow all the requirements.

Real-World Examples of Solar Tax Credit Savings

Let's look at some examples to illustrate how much you could potentially save with solar incentives. Imagine you live in California and install a $25,000 solar system. With the 30% Federal Solar Tax Credit, you'd save $7,500. California also has a Self-Generation Incentive Program (SGIP) that offers rebates for battery storage. If you add a battery to your system, you could potentially get another $2,000-$3,000 in rebates. That's a total savings of $9,500-$10,500!

Another example: Let's say you live in Massachusetts and install a $15,000 solar system. With the 30% Federal Solar Tax Credit, you'd save $4,500. Massachusetts also has a program called SMART (Solar Massachusetts Renewable Target) that provides incentives for solar generation. You'd receive payments for every kilowatt-hour of electricity your solar panels produce. Over the lifetime of your system, these payments could add up to thousands of dollars.

Top Solar Panel Brands and Their Tax Credit Eligibility

Choosing the right solar panels is crucial for maximizing your savings and getting the most out of your solar investment. Here are a few popular brands and some considerations for their tax credit eligibility. Remember, as long as the panels are new and installed at your residence, they should be eligible for the Federal Solar Tax Credit.

SunPower Solar Panels High Efficiency and Premium Cost

SunPower is known for its high-efficiency solar panels, which means they can generate more electricity in a smaller space. This is great if you have limited roof space. SunPower panels are typically more expensive than other brands, but their higher efficiency can offset the cost over time. Popular models include the A-Series and the X-Series.

Typical Use Case: Homes with limited roof space or high energy demands.

Price Range: $3.00 - $4.50 per watt.

LG Solar Panels Reliable Performance and Good Value

LG (now exiting the solar panel market, but panels are still available) was a well-respected brand known for its reliable performance and good value. Their panels were a good middle-ground option, offering a balance of efficiency and affordability. While LG is no longer manufacturing panels, you may still be able to find them through installers or distributors.

Typical Use Case: General residential solar installations.

Price Range: $2.50 - $3.50 per watt (if available).

REC Group Solar Panels Durable and Cost-Effective

REC Group is a popular choice for homeowners looking for durable and cost-effective solar panels. They're known for their high-quality materials and rigorous testing. REC panels are a good option if you live in an area with harsh weather conditions.

Typical Use Case: Homes in areas with extreme weather.

Price Range: $2.30 - $3.20 per watt.

Panasonic Solar Panels High Performance and Extended Warranty

Panasonic is known for high-performance panels with an extended warranty. They offer a good balance of efficiency, reliability, and customer support. Their EverVolt series is a popular choice for residential installations. Panasonic's all-black panels are also aesthetically pleasing for homeowners concerned with curb appeal.

Typical Use Case: Residential installations where performance and aesthetics are important.

Price Range: $2.80 - $3.80 per watt.

Understanding Solar Inverters and Their Impact on Tax Credits

The inverter is a critical component of your solar system. It converts the DC electricity generated by your solar panels into AC electricity that can be used by your home. Inverters are also eligible for the Federal Solar Tax Credit, so be sure to include their cost when calculating your tax credit.

Types of Inverters:

- String Inverters: These are the most common type of inverter. They connect to a string of solar panels.

- Microinverters: These are small inverters that are installed on each individual solar panel. They offer better performance in shaded conditions.

- Power Optimizers: These are similar to microinverters, but they don't convert the DC electricity to AC electricity at the panel level. Instead, they optimize the DC voltage to improve overall system performance.

Solar Battery Storage Systems and Maximizing Your Savings

Adding a battery storage system to your solar panels can further increase your savings and energy independence. Batteries allow you to store excess solar energy generated during the day and use it at night or during power outages. Solar batteries are also eligible for the Federal Solar Tax Credit.

Popular Solar Battery Brands:

- Tesla Powerwall: A popular and well-known option.

- LG Chem RESU: A reliable and high-performing battery.

- Enphase Encharge: An integrated battery solution with microinverter compatibility.

Comparing Different Solar Panel Options and Finding the Best Fit for You

Choosing the right solar panels can feel overwhelming, but here's a simple comparison to help you decide. Consider your budget, energy needs, available roof space, and aesthetic preferences. Talk to several installers to get quotes and compare different options. Don't be afraid to ask questions!

Here's a quick comparison table:

| Panel Brand | Efficiency | Cost | Durability | Warranty |

|---|---|---|---|---|

| SunPower | High | High | Good | Excellent |

| LG (if available) | Medium | Medium | Good | Good |

| REC Group | Medium | Medium | Excellent | Good |

| Panasonic | High | Medium-High | Good | Excellent |

The Future of Solar Incentives and What to Expect

The future of solar incentives looks bright! The Federal Solar Tax Credit is currently set at 30% through 2032, providing long-term stability for the solar industry. Many states are also committed to supporting solar energy through various incentives and programs. As solar technology continues to improve and become more affordable, it's likely that solar will become even more widespread in the coming years.

So, what are you waiting for? Going solar is a smart investment that can save you money, help the environment, and increase your energy independence. Take advantage of the available tax credits and incentives and start enjoying the benefits of solar power today!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)